Robotic Process Automation Is Transforming Accounting and Auditing

RPA in Public Accounting Practice

RPA has already garnered interest from public accounting firms, particularly with respect to taxation, advisory, and assurance services. For example, a significant portion of tax activities, such as the calculation of book-tax differences and the preparation of tax returns, has been successfully automated by RPA software robots. Revenue is generally a high-risk area in audit engagements, and automating the tasks that do not require auditor judgment has the potential to improve audit quality by reallocating the work of auditors to analyzing the differences generated by the RPA software.

RPA for Reconciliation and Analytical Procedures

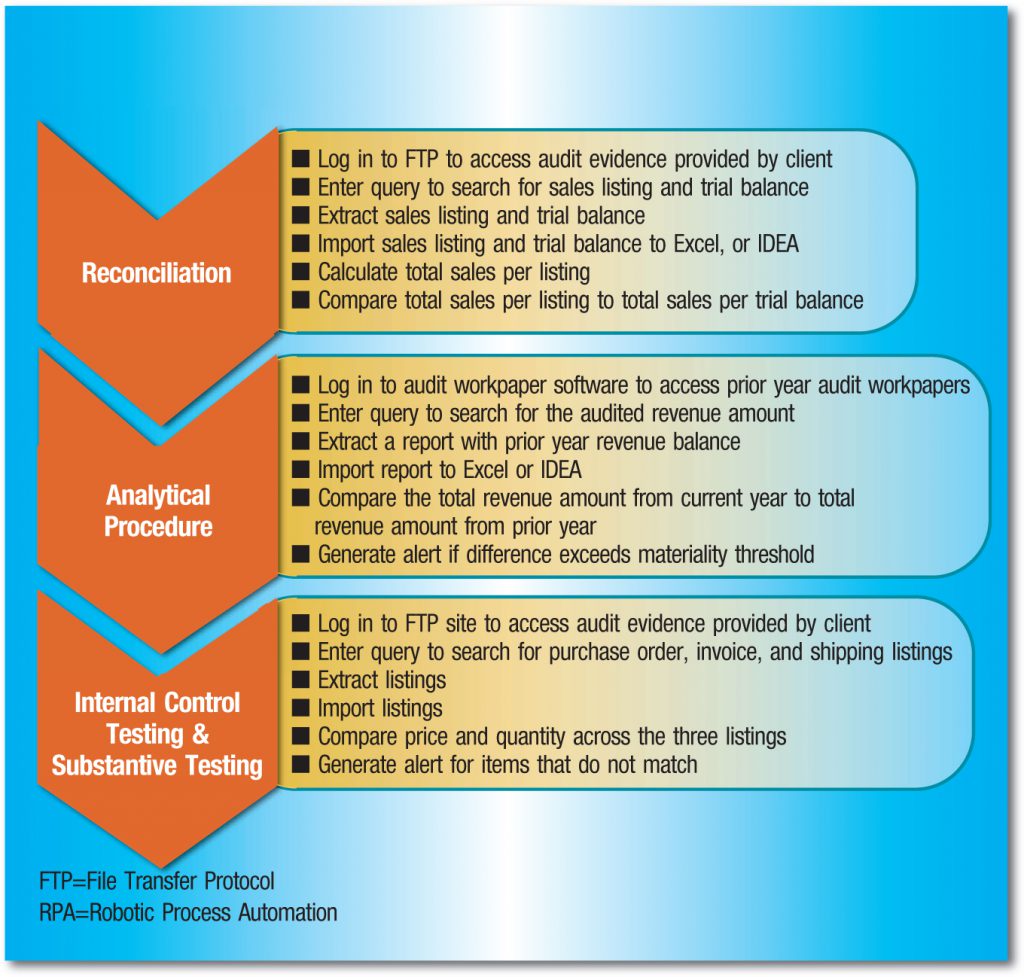

In the audit of revenue, RPA can assist auditors by logging into a client’s secure file transfer protocol (FTP) site to retrieve related audit evidence, including the listings for current and prior year sales and the trial balance. RPA can then calculate the total sales per the listing and compare it to the total per the trial balance. Assuming the amounts reconcile, RPA can subsequently calculate whether the total revenue amount from the current and prior year listings is materially different, and generate an alert if the difference exceeds the materiality threshold.

RPA for Dual-Purpose Audit Tests

RPA can be programmed to calculate whether the price and quantity are different across sales invoices, sales orders, and shipping documents, and to generate alerts for sales transactions that contain differences in price and quantity

Three-Step Approach to RPA-Based Audits

RPA implementation consists of three main stages: 1) process understanding, 2) audit data standardization (ADS), and 3) execution of automated audit tests (i.e., audit apps)

Reach out to IgniteCorp@igniterpa.com for further discussions.